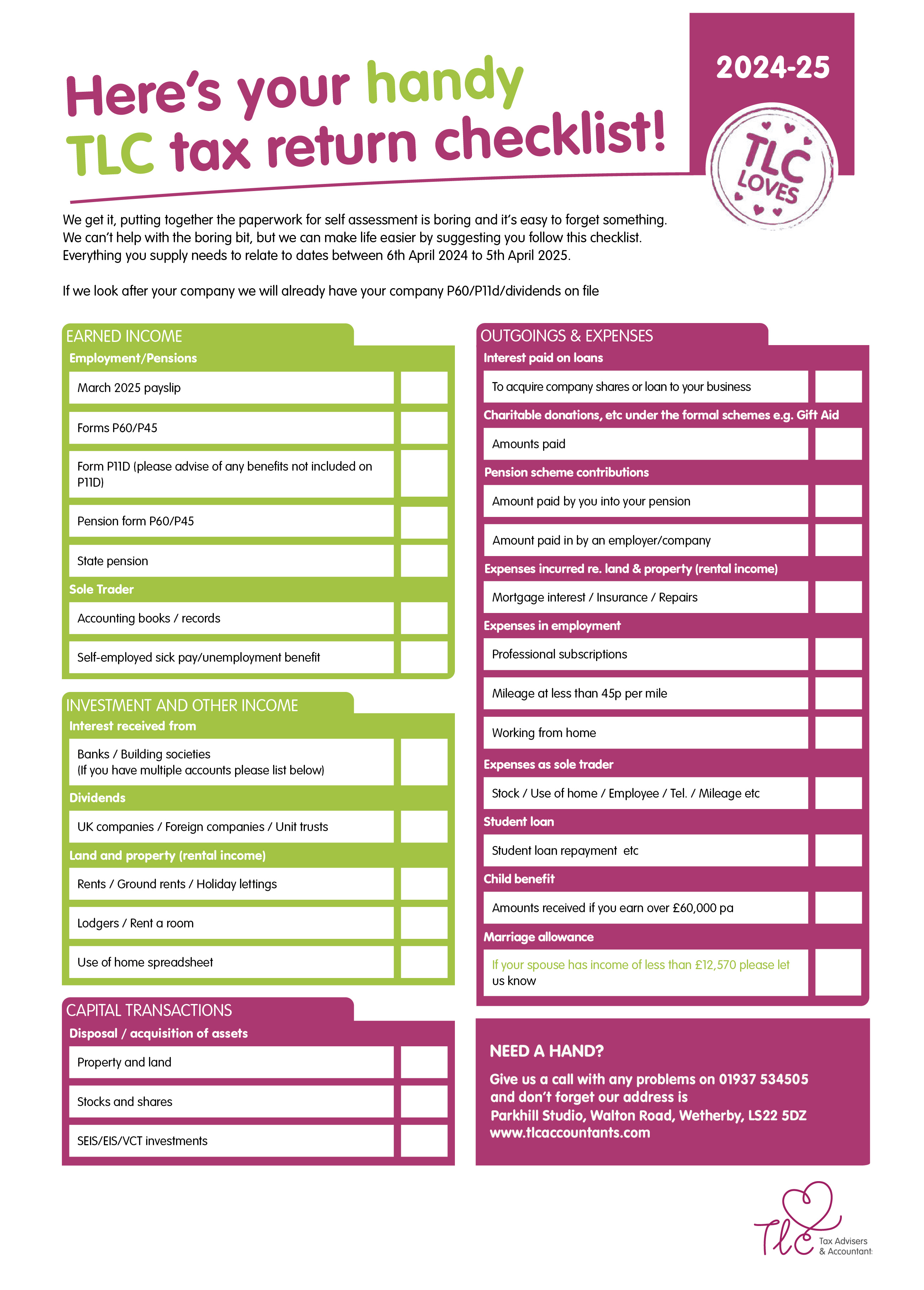

Your self assessment checklist 2024/25

8th April 2025

Here’s your handy checklist for getting all of your self-assessment information together for the tax year ending 5 April 2025. Remember the return needs to be filed and you need to have made your first payment by midnight on 31 January 2026. Access the checklist here >>> TLC-Self-Assessment-24-25

Company car tax: EVs are still the way to go over hybrids

23rd October 2025

In our January blog, ‘2025 company car tax changes businesses should be aware of’, we flagged that you should proceed with caution on hybrids, with zero-emission electric vehicles (EV) being the long-term preferred route. Fast forward to October, and those recommendations still ring true. The Benefit in Kind (BiK) framework and future tax percentages laid […]

Making Tax Digital for Income Tax – What you need to know

20th May 2025

Making Tax Digital for Income Tax is set to change the way millions of business owners and landlords report their earnings to HMRC. While the second stage of Making Tax Digital doesn’t come into effect until 6 April 2026, if you’re a self-employed business owner or a landlord, here’s what you need to know… What […]

Your Most Tax-Efficient Director’s Salary for 2025/26: What You Need to Know

17th April 2025

With the first pay date of the 2025/26 tax year almost upon us, you might be asking: what’s the most tax-efficient salary strategy for the year ahead? As usual, we’ve crunched the numbers for you… This year, the reduction of the Employer’s National Insurance Contribution (NIC) threshold adds another level of complexity – and admin. […]

2025 company car tax changes businesses should be aware of

21st January 2025

Upcoming changes to company car tax, particularly to the Benefit in Kind (BiK) rules, are set to make some vehicles much less attractive to businesses signing up for new cars and fleets in 2025. With BiK rates confirmed up to 2029/30, you’ll need to consider how these changes affect the cost over any new vehicles’ lifetimes. […]

Planning a Christmas party for your staff? Here are the tax rules you need to know…

25th November 2024

As we approach Christmas, thoughts naturally turn towards staff parties and celebrations. But in 2025, getting merry doesn’t necessarily mean copious amounts of booze. According to The Drink Business, almost a quarter (21%) of Christmas parties were alcohol-free in 2024. So, with team-building ‘activity’ style options like axe throwing and escape rooms growing in popularity, […]

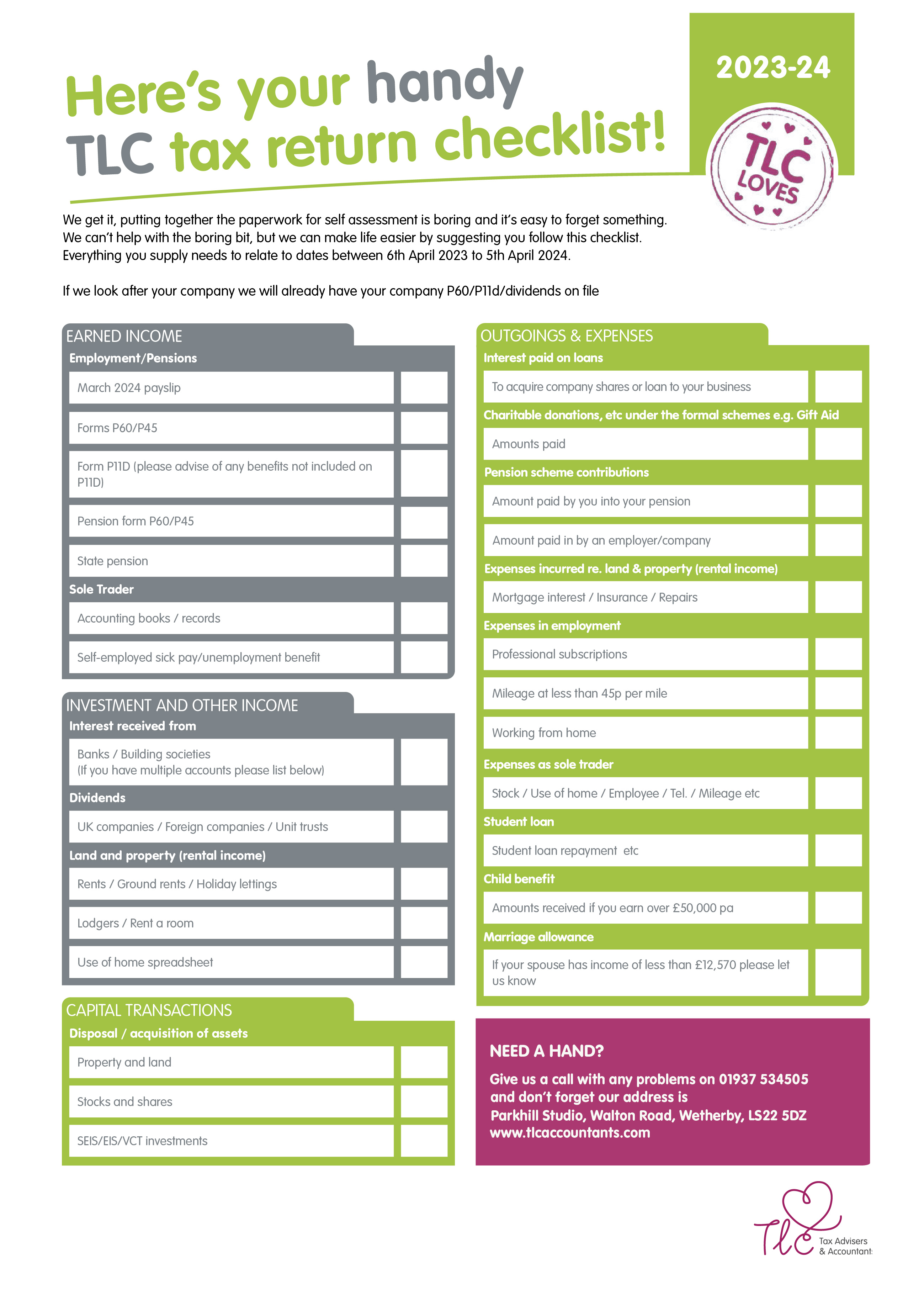

Your self assessment checklist 2023/24

30th April 2024

Here’s your handy checklist for getting all of your self-assessment information together for the tax year ending 5 April 2024. Remember the return needs filing and you need to have made your first payment by midnight on 31 January 2025. Access the checklist here >>> TLC-Self-Assessment-23-24

The most tax-efficient limited company director’s salary for 2024/25

4th April 2024

As we head into a new tax year, we’ve been doing our homework in the background as usual to come up with the best strategy for directors’ salaries. We work on the basis of making the most of your tax allowance and taking account of things like changes in the dividend allowance and impact on […]

What’s the plan? Are you ready to thrive in 2024?

7th December 2023

This guest blog is by TLC client Michael Stewart. With a background in business finance, marketing, sales, management and elite sport, he brings a unique energy to helping businesses to grow, become more profitable and more financially sustainable. There’s no doubt that 2023 threw everybody plenty of financial challenges. Skyrocketing prices, problems with getting […]

TLC Loves… taxman-friendly gifts at Christmas

26th October 2023

With November fast approaching it’s definitely time to think about Christmas, even if you don’t actually do anything about it just yet. Most small businesses want to send a small gift to their key clients to say thanks for the business, so here are the things you need to bear in mind when ordering your […]