We Totally Love Calculators!

Thanks for stopping by. We hope you’re here because you’ve heard good things from one of our clients and want to see how we can help you too. Or because you’re looking for an accountant or tax expert that does things a little differently. Yes, we crunch numbers, are fluent in ‘spreadsheet’ and do all the things a good accountant does. But what makes us different, really different, is that everything we do is about you. Your business, your goals, your needs. Simple. Sound like what you were looking for?

Who we are

James Lister MAAT

Call me a geek but I love detail - and that's a good thing for an accountant, right? I also love technology and using it to make your life easier or to save you money. If you've got a query, I'm always at the end of the phone but I won't wait for you to get in touch, I'll be actively looking for ways to make you more efficient and reminding you of key dates so you can keep on top of your numbers.

Connect with me

Claire Mattison CTA ATT

I was once told that I was the opposite of what most people believe a tax accountant to be. Well if that makes me not grey, not old and not stuffy, then I'm happy with that. No matter how small your business, I'm passionate about helping you grow by giving great advice and using my network to put you in touch with others who can help. I want to know you as a person, not just about your business, as I firmly believe that's the best way to give a great service.

Connect with meOur Packages

Don’t you just love ice cream? It has universal appeal, it’s easy to order and the options are endless – a lot like our service.

Finding out how much it will cost to have TLC take accounting off your to-do list is as simple as 1, 2, 3.

- 1 Choose whether you’re running a limited company, are a sole trader or a landlord and you’ll be taken to our unique build-your-own ice cream quote system

- 2 Read through the description so you know what’s included in the standard monthly cost

- 3 Personalise your ice cream with any of our added extras – the flake, sprinkles and sauce bit of our service. Simply click the button next to the service you want to add and the cost will be updated in the box at the bottom

Don’t worry if you find you’ve placed your order and want to change the flavour of your ice cream or add an extra topping, we’ll be pleased to help you with that.

Can’t see what you want? We can also advise on investment tax relief schemes, or provide you with a fully outsourced finance department. Give us a call on 01937 534 505 to discuss what you need.

Monthly Fee - £50

Welcome to our standard sole trader package

- Give you a spreadsheet or advise you on the most suitable software (we love Xero) to help with your book-keeping, plus our support

- Prepare year end accounts for the sole trader business

- Do your business tax computations linked to the accounts

- Prepare and submit your personal tax return, including self-employed profits

- Calculate and advice of your personal tax liabilities

- General business support and advice on being tax efficient and maximising deductible business expenses

- Unlimited email/telephone support

- One year end meeting per annum

Monthly Fee - £120

You need a bit more ice cream - or service, as we like to think of it. With your double scoop you'll get:

- Use of our address as your Registered Office if you want it

- Our team dealing with all the forms for Companies House and HMRC

- Support and advice on systems, processes and finances including Xero support if you’ve chosen that option AND book-keeping advice. You can even have a template spreadsheet if you want it

- Discussions about tax efficient planning for yourself and partner, including advice on appropriate remuneration for the director (salary, dividend strategy etc.)

- Your payroll run each month, including supplying payslips by email and all HMRC reports (RTI submissions) for one director

- A personal tax return prepared for one Director

- Your Statutory Accounts prepared at the end of the financial year – a full set for you and an abbreviated set for Companies House

- Your corporation tax liabilities calculated so you know what you will need to pay

- Your Company Tax Return prepared and submitted at the end of the financial year

- Your Annual Return prepared and submitted to Companies House

- Unlimited email/telephone support

- One year end meeting per annum

- A quarterly review with an update on your Director’s loan and corporation tax position

Monthly Fee - £15

We love dealing with landlords and have created a simple service so you can opt in and out of the bits most relevant to you. Our standard service – the ice cream cone if you will – is an annual personal tax return for £15. Click on the buttons to add anything else you’ll need and the price will show in the box below.

One-off Fee - £195

Secure your assets by forming a limited company

We will:

- Register your company with Companies House, including appointing directors.

- Make our address available for use as your registered address if necessary

- Notify HMRC that you’ve started trading (by submitting the snappily-named form CT41G).

- Register the company for VAT at the appropriate rate if applicable

- With your agreement, let HMRC know we are able to act as your agents (another snappy name this one, it’s a 64-8 form this time).

- Register the directors with HMRC for personal self assessment.

- Produce a full constitution for your company including the following electronic documents:

- Certificate of Incorporation

- Memorandum of Association

- Articles of Association

- Minutes of the first Directors/Shareholders meeting

- Company Register – Members Certificates and Minute Book

- Introduce you to banks or brokers for access to finance as required

Your Monthly Fee

Get in touch

Welcome to our blog aka TLC Loves!

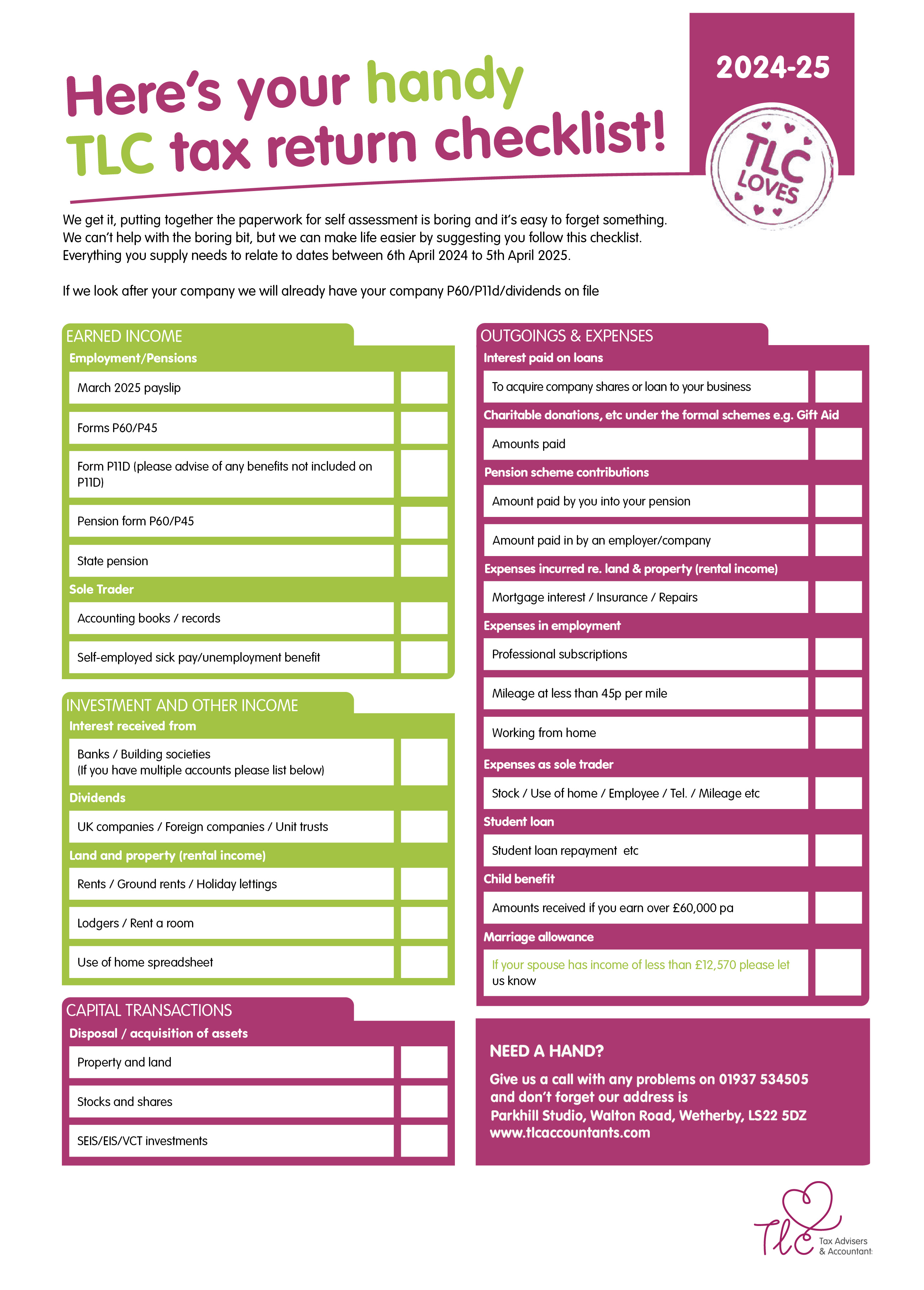

Your self assessment checklist 2024/25

8th April 2025

Here’s your handy checklist for getting all of your self-assessment information together for the tax year ending 5 April 2025. Remember the return needs to be filed and you need to have made your first payment by midnight on 31 January 2026. Access the checklist here >>> TLC-Self-Assessment-24-25

Company car tax: EVs are still the way to go over hybrids

23rd October 2025

In our January blog, ‘2025 company car tax changes businesses should be aware of’, we flagged that you should proceed with caution on hybrids, with zero-emission electric vehicles (EV) being the long-term preferred route. Fast forward to October, and those recommendations still ring true. The Benefit in Kind (BiK) framework and future tax percentages laid […]

Making Tax Digital for Income Tax – What you need to know

20th May 2025

Making Tax Digital for Income Tax is set to change the way millions of business owners and landlords report their earnings to HMRC. While the second stage of Making Tax Digital doesn’t come into effect until 6 April 2026, if you’re a self-employed business owner or a landlord, here’s what you need to know… What […]